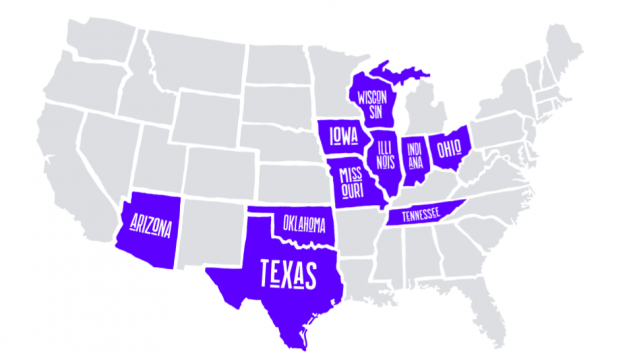

Voom, an innovative motorcycle insurance provider that allows you to pay by the mile, has expanded its current coverage map to include three new states: Texas, Missouri, and Tennessee. This brings Voom’s current coverage map up to 10 states, with Arizona, Oklahoma, Iowa, Illinois, Wisconsin, Indiana, and Ohio being the other states already serviced.

For the uninitiated, Voom is the first of its kind – providing usage-based insurance options for underserved mobility segments. In this case, the motorcycle community – or some of it, for now. Voom is a licensed insurance broker in all 50 states, and the way it works is that it provides coverage for riders who log 2,000 miles or less per year.

“We surveyed hundreds of riders and found that 70% ride 2,000 miles a year or less. The results of this study are correlated to the findings of the recent behavioral safety research done by the NHSA. These riders are actually overpaying to cover the risks of a few lucky riders who ride more often”. Said Ori Blumental, VOOM CO-founder & CTO.

For you, the end user, the process is really easy. Riders report their mileage by sending in a picture of their odometer, with no tracking or hardware required. The bike is covered, even when someone doesn’t ride any miles for a particular month. In addition to the 10 states currently covered, Voom is working on adding additional states like Minnesota, Florida & Georgia.

Why should you care? Because if you’re, say, a weekend warrior or occasional rider, in a covered state who rides less than 2,000 miles a year, you can save up to 60% compared to traditional motorcycle insurance plans. To sweeten the pot, if you own more than one motorcycle, the mileage count applies per bike, not overall. Plans start as low as $50 per year. In an age of inflation, VOOM aims to help riders keep more money in their pockets.

To learn more visit voominsurance.com.

The post Voom Pay-Per-Mile Insurance Expanding Its Coverage To 10 US States appeared first on Motorcycle.com News.