Let’s face facts, despite the best preparations, defensive habits on the road, and not pushing beyond one’s own skill limits, there are times when fate steps in and things just happen. They are called accidents for a reason. It can be a small patch of gravel, a car pulling out without looking, or a hundred and one other things.

The biggest part of going through insurance is filing a claim. Often, there are documents you need to fill out, police reports or DMV reports you need to gather, things to sign, calls you need to make, and the like. Often, you will need to know your insurance policy number, file number for your police report or DMV report, but one thing that is often not explained very well is that you may also need what is known as the NAIC number for your insurance.

What Is An NAIC Number?

There are a couple of ways to explain it, but the simplest is by pure definition. NAIC stands for National Association of Insurance Commissioners. This association has 150 years of history, being the de facto standard setting and regulatory commission for the insurance industry. Every major insurance company in the US is part of the NAIC, and almost 95% of the minor insurers are also members.

Each one of these insurance companies, when they become members, is issued an identification number. This number is unique, and is made up of five characters currently. There are provisions to make it six numbers if enough insurance companies come into existence that a six character identifier is needed.

The NAIC number is also used by the regulatory and competition committees of the NAIC itself to promote competition within the industry in a fair environment for both policyholders (i.e. you and me) and the policy providers. This prevents one insurance company from monopolizing a sector of a certain industry, from production insurance for a movie studio to automotive and motorcycle insurance for the common layman.

It also binds those insurance companies in each sector to a standardized set of rules and regulations that must be adhered to. For example, in the automotive and motorcycle insurance sector, insurers are, at minimum, bound by regulations to provide liability insurance and comprehensive insurance. This ensures that any insured party will have at least the correct coverage for incidents outside of their control (“Acts of God”) as well as against property, personal, or medical damages.

Why Is An NAIC Number Important?

In many other nations around the world, insurance is bound either by a provincial standard such as in Canada, or by a base set of federalized rules. In both these cases, while there are anti-monopoly measures in place, some insurance has been mandated to be from one provider, and one provider only. This can be seen in the province of British Columbia in Canada, where the provincial government has a Crown Corporation (what we call a Federal Corporation here in America) known as the Insurance Company of British Columbia, and there are no alternatives for automotive or motorcycle insurance.

As pointed out earlier, the NAIC, and the number assigned to each insurance company, means that this kind of state-level monopoly cannot exist in the USA. While there can be only one or two companies in a specialized sector of insurance, the NAIC Number identifies them and the policies, rules, and regulations they must adhere to. To think of it in a different way, it’s insurance against the insurance company doing what they want to.

However, the biggest reason that an NAIC Number is vital is that it is used nationwide to quickly process the start of an insurance claim. When filing for a DMV report, or filling out an insurance claim, it may be a requirement to provide your insurance company’s NAIC number. In very few, select cases, it is not needed, but 90% of the time you will be using the number to identify who you are insured through.

This allows any legal authority involved in the claim, namely the police, the DMV, the other party’s insurance company, and the like to simply enter a number into the files for the proceedings to gather all relevant information about that insurer. In a nation with over 360 million citizens, if every claim had to be filled out in triplicate, faxed/email/snail-mailed, found out that there is a typo in the name, have it come back, refilled out, and on and on, it would slow things down to an absolute crawl.

With the NAIC number, it’s entered into the filings, all relevant names, addresses, main counsel, et al are listed, what rules and regulations they are bound by, and off to the courts you go with your claim. This isn’t to say that the insurance claims process cannot be dragged out for months or even years, but getting the whole thing going in the first place allows for at least the initial phase to be done quickly.

How To Find Your NAIC Number

As the NAIC Number is both a legal requirement for almost all insurance companies, and a vital bit of information for a policyholder, we contacted 4AutoInsuranceQuote, one of the main quote search engines in the USA, to help define the main ways to find your specific Geico NAIC number.

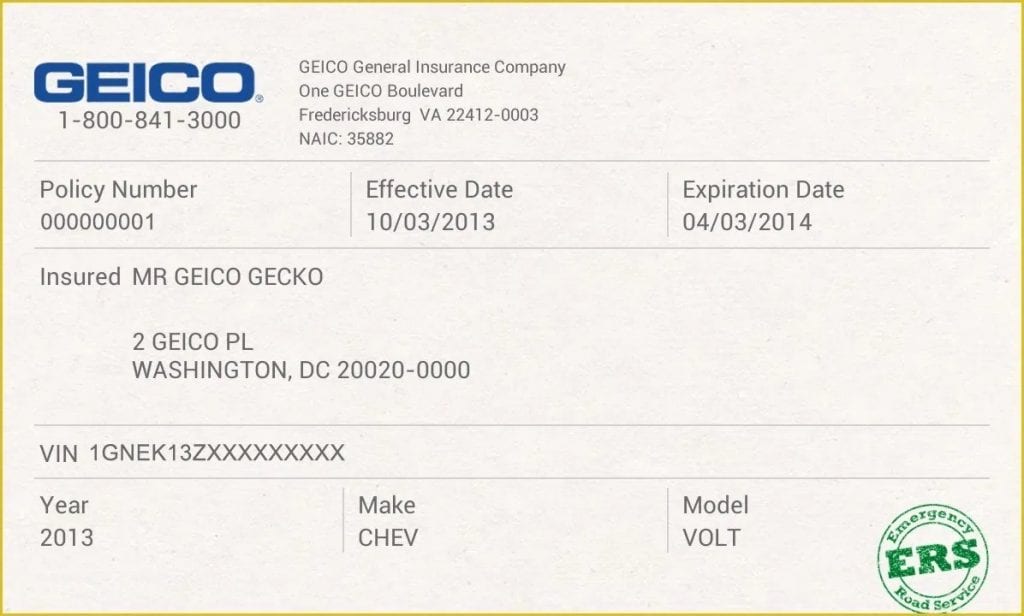

The most common way to find your NAIC number is to look at your policy card, or more correctly the proof of vehicular insurance card that your insurance company sends you. Where it lists your policy number, there will either be a five character code before or after it, depending on your state and insurer. Otherwise, the code is either beside the insurer’s name, or on the reverse side of the card in the “what to do if you’re in an accident” guidelines.

If you have the full, detailed policy documents on hand, you will know that there are multiple pages in it that seem to make no sense, or have complicated codes and listings on them. However, almost all insurers will also include a Declarations of Insurance Coverage page, or simply a Declarations page. On this page, you will find the NAIC number in the section covering the name and address of the Insurer.

The third way to find the NAIC number is to quite simply Google search for it. Use the layout of “(Insurer’s name without brackets) NAIC number.” For example, if you’re with the insurance company XYZ Insurers, you’d simply Google “XYZ Insurers NAIC number.” It will always appear as a separate box above the search results.

The fourth way to find the NAIC number is, quite simply, to ask your insurer. On all the proof of coverage cards, there is a 1-800 number to call your company directly. If you have your insurance through a brokerage, you can also call the broker and they will know, or can find out for you very quickly.

The final way to find an NAIC number is to visit the NAIC webpage at NAIC.org. Enter your insurer’s name, the type of coverage you have (in this case vehicular), and press “Search.” 99% of the time, it will give you a result.

If none of the above mentioned methods work, then it is likely that either your insurer is very new to the NAIC, or has not joined the association and is therefore not bound by the policies, rules and regulations of it. This is not to say that your insurer is bad or corrupt or anything nasty, it’s just that they have decided to not join the association.

Source: MotorbikeWriter.com